Blog

Non-profit says states must invest in freight network

As vehicle travel returns to pre-pandemic levels and federal transportation funding from the Infrastructure Investment and Jobs Act (IIJA) begins to reach states, it will be critical that states make additional investments to improve the efficiency and condition of the nation’s freight network to minimize supply chain disruptions, according to a new report released today by TRIP, a Washington, DC based national transportation research non-profit.

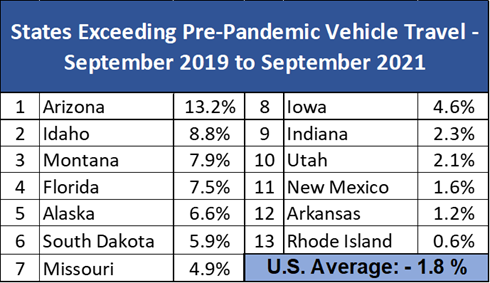

The TRIP report, “The U.S. Freight Network’s Critical Role in the Supply Chain” examines the latest information on the condition and reliability of the nation’s supply chain and the critical role of the U.S. freight transportation network in keeping the U.S. economy moving. The report finds that, while U.S. vehicle miles of travel (VMT) bottomed out in April 2020 at a level 40 percent below that in April 2019, by September 2021, U.S. VMT had rebounded to 1.8 percent below September 2019 levels. Vehicle travel in the 13 states listed in the chart below has now surpassed pre-pandemic rates. VMT data for all 50 states can be found in the report’s appendix.

While national vehicle miles of travel dropped by as much as 40 percent during the pandemic, freight movement fell by just 10 percent by April 2020, demonstrating the resilience of the supply chain and the nation’s reliance on freight movement. National freight movement – including for-hire trucking, freight railroad services, inland waterway traffic, pipeline movements and air freight – peaked in August 2019, bottomed out to its lowest level in April 2020, and by September 2021 had rebounded to within two percent of September 2019, the most recent pre-pandemic September.

“With more than $650 billion in goods moving through the state each year, Indiana plays a critical role in the international supply chain,” said Bryce Carpenter, vice president of industry engagement for Conexus Indiana, a nonprofit industry-led initiative focused on strengthening Indiana’s advanced manufacturing and logistics industries. “Indiana has the most pass-through interstates, has 43 freight railroads, the eighth largest cargo airport and ships 65 million tons of cargo a year. Indiana has continually invested in strengthening its ‘Crossroads of America’ position, whether through infrastructure investments or innovations to improve connectivity. We must continue – and even accelerate – investments to ensure the safe and efficient delivery of goods to consumers around the world and to support economic growth.”

Congestion and decreased or unpredictable reliability on the nation’s freight transportation network can impact delivery times and hinder the delivery of goods, supplies and raw materials, disrupting manufacturing supply chains and prolonging the time it takes for customers to receive their orders. Traffic congestion can increase the cost of goods and services as a result of increased delays. The Texas Transportation Institute, in its 2021 Urban Mobility Report, found that increasing traffic congestion resulted in a 77 percent increase in traffic delays for commercial trucks from 2000 to 2019, increasing from 219 million hours to 387 million hours.

“This latest TRIP report highlights the critical role the operation of the nation’s supply chain has on economic growth and quality of life for all citizens,” said Ed Mortimer, vice president of transportation infrastructure at the United States Chamber of Commerce. “With passage of the Bipartisan Infrastructure legislation, new federal resources will join with state, local and private partners to modernize the freight network in a one-in-a-generational opportunity to rebuild and innovate, ensuring America’s competitiveness long into the 21st century. It’s time to get to work!”

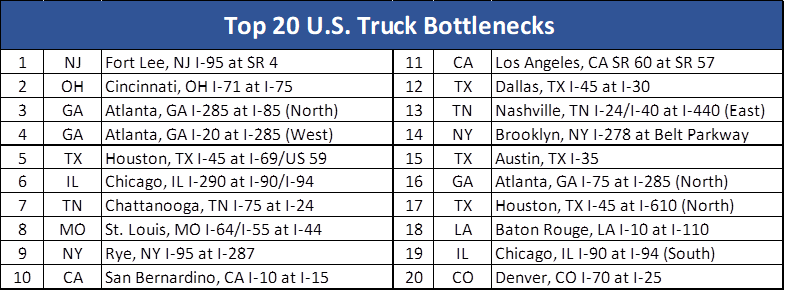

The American Transportation Research Institute (ATRI) prepares an annual list of the nation’s top 100 truck bottlenecks, based on the analysis of a massive database of truck GPS data, to quantify the impact of traffic congestion on truck-borne freight. The chart below shows the top 20 truck bottlenecks.

“Highway bottlenecks cost the trucking industry more than $75 billion each year, contributing to the recent surge in inflation and driving down supply chain efficiencies,” said Bill Sullivan, executive vice president of advocacy for the American Trucking Associations. “The TRIP report provides some of the starkest evidence yet of the dire consequences of underinvestment in our nation’s most critical infrastructure. IIJA provides the greatest opportunity in a generation to address these deficiencies and addressing highway freight bottlenecks must be given the highest priority by federal and state departments of transportation.”

Reliability in the ability to predict freight travel times is of critical importance, particularly to industries that rely on “just in time” manufacturing to have the right material, at the right time, at the right place, and in the exact amount needed. Late deliveries can have costly ripple effects and can cause costly disruptions in the production process. Decreased reliability also requires drivers to budget extra time, track routes in real time and make route adjustments to account for inconsistent travel times and delays. The following chart indicates the nation’s ten least reliable major freight highway corridors, based on a reliability index that indicates how much longer travel times are on heavy travel days, compared to normal days (the top 25 are listed in the report). The numbers after the decimal point can be treated as a percentage; a corridor with a travel time reliability index of 1.50 had travel times that were 50 percent longer on heavy travel days, compared with normal days.

The condition of the nation’s freight network can greatly impact the delivery of goods. The pavement life cycle on the National Highway Freight Network, which includes the nation’s major freight routes, is greatly affected by state and local governments’ ability to perform timely maintenance and upgrades to ensure that road and highway surfaces last as long as possible. The TRIP report finds that four percent of pavement on the National Highway Freight Network are rated in poor condition, while 19 percent are rated in fair condition and the remaining 77 percent are rated in good condition. Four percent of National Highway Freight Network bridges are rated in poor condition, 43 percent are rated in fair condition, and the remaining 53 percent are rated in good condition.

Signed into law in November 2021, the Infrastructure Investment and Jobs Act will increase investment in highway, road and bridge projects needed to improve the efficiency of the nation’s supply chain. The IIJA will provide $304 billion for highways, roads and bridges over the next five years through September 30, 2026 — a 34 percent increase over current funding levels.

Improving the condition and performance of the nation’s network of roads and bridges will require a significant increase in investment. According to the Status of the Nation’s Highways, Bridges and Transit: Conditions and Performance Report to Congress released by the United States Department of Transportation in 2021, the U.S. would need to increase annual road, highway and bridge investment by 55 percent over the current level of highway investment to make significant improvements in road and bridge conditions, reduce traffic congestion, and improve traffic safety. The nation currently faces a $1 trillion backlog in projects needed to improve reliability, safety and conditions.

“In the short term, improving the performance of the nation’s supply chain will require addressing the many supply chain challenges that are restricting the timely movement of freight,” said Dave Kearby, TRIP’s executive director. “But ensuring that the nation’s long-term goals for economic growth and quality of life are met will require investing adequately in an efficient transportation system that will provide the U.S. with a reliable supply chain.”